Good corporate governance and ethical practices by companies are considered essential for well functioning capital markets all over the world. Ethical practices, transparency in dealings, better investor protection and efficient boards boost investor confidence and lead to capital inflows in markets. A comparison of the BRICS nations with developed nations on 5 parameters of corporate governance, as reported in the World Economic Forum Global Competitiveness Report 2013-14, shows why South Africa earned the reputation of ‘safe haven’ for investors.

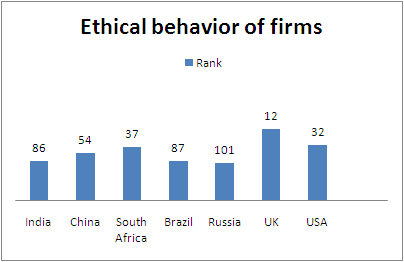

Ethical Behavior of Firms

Ethical behavior is assessed by company policies on bribery, kickbacks, protection money, facilitation payments, gifts, fraud, money laundering, and political and charitable contributions. Management systems and procedures outlining frameworks for risk assessment, sanctions, whistle-blowing, continuous internal self-review and external reporting also fall under the purview of ethical behavior. In 2013, South Africa ranked at No37 on ethical behavior, ahead of other BRICS nations, with China at a distant 54th rank. India & Brazil ranked 86th and 87th and Russia ranked the lowest among BRICS nations on this parameter.

Strength of Auditing and Reporting Standards

Fair practices and transparency in dealings are critical to attracting foreign investments.

No comments:

Post a Comment